Financial Wellness

This involves the ability to have enough money to meet practical needs and a sense of control over and knowledge about personal finances.

Building Financial Wellness helps you recognize what triggers spending, how using credit leads to debt, and ways to cope with challenging feelings about money. You can learn to set attainable financial goals to increase sense of control over personal finances.

Many free smartphone apps are funded through advertisements or require payment to access certain features, so check app reviews before downloading. Be cautious when using or signing up for web-based apps, especially if they require you to register. You can learn more about security when using apps from the website for the U. S. Federal Trade Commission.

More resources for financial wellness

Managing Your Finances

Take time to Set Financial Goals

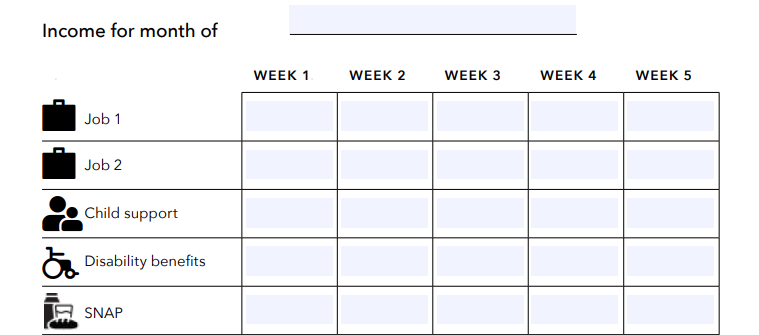

Get a handle on your financial picture with this Income and Benefits Tracker

25 Tips to Improve Your Financial Well-Being

Budgeting

These tips can help you Make a Budget

Plan ahead with this Budget Worksheet

Keep track of what’s due with this Bill Calendar

Watching What You Spend

Know where your money goes by using this Spending Tracker

This list of ideas suggests ways you can Stay on Budget

Banking

This resource suggests ideas to help you Manage Your Checking Account

Learn about safe Online Banking with these tips for beginners

Shopping Wisely

Follow these guidelines for safe and secure Online Shopping

Resources for Wellness in Eight Dimensions

Learn the Eight Dimensions of Wellness (poster) | SAMHSA

Eight Dimensions of Wellness Daily Plan | UIC Solutions Suite for Health and Recovery

While we list online resources, we recognize that websites often change and move . If a link doesn’t work, try a search using the title. We do not endorse any specific websites—they are suggestions for beginning your search for what works for you. We do not accept funding or other support from the resources listed.